Contact us

Get in touch with our experts to find out the possibilities daily truth data holds for your organization.

Persistent Monitoring

Natural catastrophe solutions

30 August 2023 | Solutions,Insurance Solutions

6 min read

Solutions Marketing Manager, ICEYE

This Q&A focuses on how exactly ICEYE can help insurers enhance three crucial areas: 1) catalyzing immediate event response and fostering proactive policyholder communication; 2) efficiently securing third-party resources; and 3) accurately sizing losses. Should you have further questions, please feel free to contact our Solutions Team.

While we receive technical inquiries regarding our Synthetic Aperture Radar (SAR) data resolution, processing, and software compatibility, we understand that the insurance realm doesn't always house SAR experts. This is where ICEYE goes the extra mile. We blend SAR imagery with auxiliary data, such as building footprints and employing an AI model combined with an expert team to provide actionable insights tailored to insurers. Essentially, we're providing a building-level dataset to discern potential structural damage. In other words, we are not providing raw SAR data to the insurance market, but instead, furnishing a constant stream of reliable information.

Our customers can also consume our insights via partner platforms such as Arturo.ai, Betterview, EigenRisk, and Esri ArcGIS.

This video illustrates how EigenPrism users can seamlessly integrate insights from ICEYE to streamline their wildfire loss estimate workflows.

A swift response is paramount in catastrophic events. When people are evacuated, they don’t know what happened to their property. It often takes weeks until they can submit a first notice of loss to their insurance company. Our data empowers insurers by providing clear situational awareness of the damage caused by the wildfire, so they know how many adjusters to deploy, and what is the required skill set for the adjuster to be effective in the field. They can also make informed decisions on whether third-party adjusters are needed.

Traditional damage detection methods like street-by-street canvassing and aerial optical imagery are weather-dependent. The information provided from these traditional methods is typically delayed by days or weeks, holding severe limitations to how informed an organization can be to execute disaster response and relief efforts.

In contrast, ICEYE ensures rapid, observation-based insights to prioritize your resources and ensure that you have enough people to address the situation on the ground. Within hours of a property being destroyed, ICEYE customers know which properties have been destroyed, regardless of weather, time of day, or location.

Our data is designed to enhance, not replace the adjuster's role. It elevates the granularity of information from mere fire perimeter assumptions to pinpointing specific damage types on both commercial and residential buildings. By discerning the extent of the damage, insurers can better allocate their ground resources. For example, if a commercial building was destroyed, you might want to send a large loss adjuster from your commercial lines. But if you are dealing with no structural damage, you may choose to send in another adjuster with less experience. Overall, ICEYE helps you understand what type of ground resources you need to send.

In a wildfire, most buildings typically remain untouched or utterly consumed. Since partial burn is not that common, we currently gauge structural damage in a binary manner.

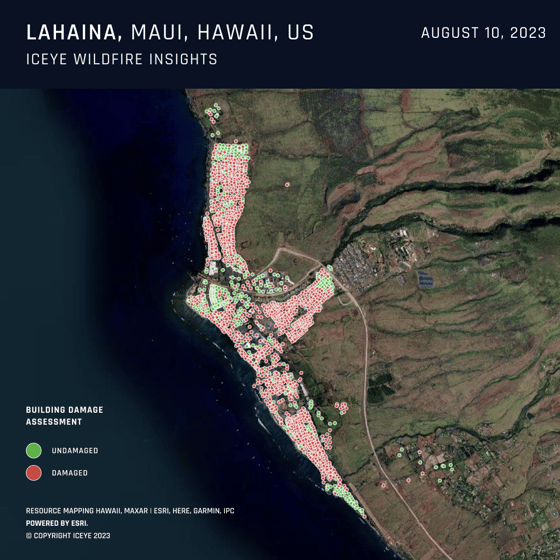

Preview of the affected region in Lahaina, Hawaii, taken from ICEYE's second wildfire analysis release.

Whenever possible, we validate our analyses using CalFire's damage data and optical aerial imagery when they become available. Our data delivery is continuously refined with each event we analyze.

For optimal results, we recommend robust geocoding of the buildings by our insurance customers, to ensure a building-level match between ICEYE Wildfire Insights data and the insured property. However, even if imperfect, the data remains valuable within fire perimeters.

At the moment, ICEYE’s Wildfire Insights include a wildfire monitoring application that displays all active events in the US and Australia, as well as a Wildfire Building Damage Assessment product, which delivers detailed damage assessments for each residential and commercial structure within the wildfire's perimeter — all within 24 hours post-impact. While we can generate burn areas via our app using 3rd party data, in the near future, we are also working to create our own product based on our SAR technology and develop a predictive feature to indicate probable fire spread directions.

Within hours of the fire damaging properties, we provide our first analysis output to our customers. After that, we also send continuous updates at 24-hour intervals to provide awareness of the situation until the fire is more than 60% contained and no more structures are threatened.

Watch the on-demand recording of our wildfire monitoring and damage assessment webinar with EigenRisk.

Watch the on-demand recording of our wildfire monitoring and damage assessment webinar with EigenRisk.

The main distinction between them and ICEYE is that our data is observation-based data of what’s actually happened. We only use AI to understand how the structures look on the ground, but our damage assessment insights are based on our near real-time observations, thanks to our SAR satellite constellation, which is the largest in the world. Instead of relying on historical trends or complex algorithms, we deliver near real-time assessments. To the best of our knowledge, Zesty.Ai is an underwriting and risk-scoring application within the wildfire monitoring ecosystem, which is a different use case than ICEYE’s.

When a major wildfire happens, even strategic, C-level executives must act operationally with limited information, which can be uncomfortable. Our rapid intelligence is pivotal for high-level decision-making, as it can instill confidence in reserving decisions and enhance clear communication with board members and shareholders. Wildfire models may be promising, but many are nascent, grossly overestimating the damage and the fire perimeters.

To learn more about ICEYE’s Wildfire Insights, which is available now in the US and Australia, click here. Alternatively, you are also welcome to explore our Flood Monitoring product.

11 December 2025

Cyclones Senyar and Ditwah: Flooding impact across Sri Lanka, Indonesia, and Thailand

2025 Cyclone Season: Insights on Cyclones Senyar and Ditwah, two powerful storms that formed in the...

Read more about Cyclones Senyar and Ditwah: Flooding impact across Sri Lanka, Indonesia, and Thailand →28 October 2025

Flood Ready: How insurers can act faster with satellite insights

Discover how satellite flood monitoring helps insurers gain real-time situational awareness and...

Read more about Flood Ready: How insurers can act faster with satellite insights →15 October 2025

From forecast to fact: Multi-peril data for insurers

ICEYE's Monte Carlo workshop revealed how SAR satellite data transforms hurricane response and...

Read more about From forecast to fact: Multi-peril data for insurers →