Contact us

Get in touch with our experts to find out the possibilities daily truth data holds for your organization.

Persistent Monitoring

Natural catastrophe solutions

28 October 2025 | Solutions,Insurance Solutions

11 min read

Solutions Marketing Manager, ICEYE

The panel brought together Laura Lazarus (Aviva), Charles Bush (Zurich), and Paul Sowden (ICEYE) to explore how insurers can respond faster, more effectively, and more empathetically to the growing flood challenge in the UK.

As flood events become more frequent and unpredictable, the discussion revealed a shared goal across the industry: bridging the gap between knowing and acting.

“There used to be a fairly traditional pattern as to when you would expect bad weather and flood,” said Charlie, noting that some of the worst recent events have come “when the ground is particularly dry during summer and you get severe flash floods.” This, he added, is “almost undoubtedly connected to climate change and it’s only going to get worse.”

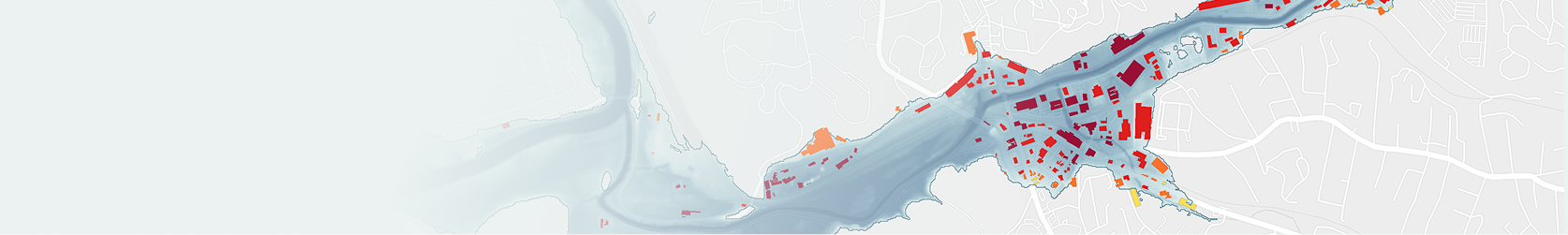

The UK’s unique topography adds to the challenge. As Paul put it, “We’re this island of valleys, and our flooding is very localized. But while it’s local, a big flood event can lead to hundreds of local events all happening at once.” He described managing flood in the UK as “a little bit like Whack-a-Mole”—making it difficult for insurers to know exactly where to deploy resources.

If one message dominated the conversation, it was speed.

“Floods are incredibly traumatic for our customers,” said Laura. “Our learning is about making sure we center our flood responses around their needs—how we can best support them, get to them quickly, and do the things that matter most as quickly as possible.”

Yet, as Paul pointed out, many insurers still find themselves “largely dependent on media reports, meteorology, and claims data to know where to prioritize response.” The result? Critical hours are lost while the true extent of the flooding unfolds.

That’s where data-driven situational awareness comes in. Paul emphasized that “technology now exists to improve that awareness from days to hours.” For insurers, those hours can make the difference between effective mitigation and costly delays.

The panel agreed that technology alone isn’t the answer, but it’s the enabler.

ICEYE’s synthetic aperture radar (SAR) satellites provide consistent, cloud-penetrating, day-and-night visibility, allowing insurers to see where floodwaters are spreading even when weather and darkness obscure the ground. As Paul demonstrated during the live demo, ICEYE’s Flood Rapid Impact Solution can deliver the first event insights within 8 to 12 hours of a flood starting, followed by continuous updates throughout its progression

This kind of early insight helps insurers allocate loss adjusters and contractors more efficiently.

said Laura. “Mapping technology coupled with our own in-house adjusting team allows us to deploy quickly where customers are most affected.”

By combining advanced satellite data with analytics and claims intelligence, insurers can better target vulnerable communities, manage surge response, and prioritize support for those hit hardest.

While technology enables faster action, the panelists agreed that human expertise remains irreplaceable.

“There’s no substitute for experience,” said Charlie. “But we need to augment that experience with digital tools like satellite imagery and drone footage, so our claims professionals can assess damage and settle claims as quickly as possible.”

Both Zurich and Aviva emphasized building future-ready talent pipelines. Aviva is bringing through graduate adjusters and running internal career schemes to ensure capability keeps pace with complexity. Charlie also noted the value of sharing best practices across the sector: “We want an industry that’s fit for purpose. Where our reputation becomes one of, ‘I’ve got an insurance policy and it does exactly what I expect it to.’”

Beyond immediate claims handling, the discussion turned to building resilience into every response.

Charlie shared how Zurich helps customers “build back better,” for instance by substituting expensive reinstatement materials with flood-resistant alternatives. “We’re not talking about betterment,” he said. “We’re talking about making commercial decisions that are right for customers. Creating a more resilient home so their lives aren’t turned upside down again.”

Laura agreed: “Once a claim is on the happy path, we need to keep it there. Analytics and technology allow us to spot when claims aren’t progressing as expected and intervene earlier to get customers back to normal faster.”

While the UK hasn’t seen a “super loss” from flooding in recent years, Paul warned that it’s only a matter of time. “We’ve been lucky, but at some point we’re going to get a significant event,” he said.

Insurers and reinsurers are now investing in scalable, data-rich capabilities to prepare for that inevitability—capabilities that convert observation into action and uncertainty into insight.

The panel's takeaway was clear: speed and precision are no longer optional. Real-time data enables insurers to make smarter, faster, and more compassionate decisions in the hours that matter most.

Flood risk isn’t waiting for anyone. The question is whether your organization is equipped to respond when it strikes.

To see how ICEYE’s satellite-based flood insights can help you act faster and with greater accuracy, watch the full on-demand webinar on YouTube or explore ICEYE’s Flood Solutions to learn how real-time situational awareness can transform your flood response strategy.

Don't miss NatCat event updates and new case studies

11 December 2025

Cyclones Senyar and Ditwah: Flooding impact across Sri Lanka, Indonesia, and Thailand

2025 Cyclone Season: Insights on Cyclones Senyar and Ditwah, two powerful storms that formed in the...

Read more about Cyclones Senyar and Ditwah: Flooding impact across Sri Lanka, Indonesia, and Thailand →15 October 2025

From forecast to fact: Multi-peril data for insurers

ICEYE's Monte Carlo workshop revealed how SAR satellite data transforms hurricane response and...

Read more about From forecast to fact: Multi-peril data for insurers →11 June 2025

6 Data-driven strategies emergency managers should use for hurricane preparedness

How Emergency Managers can ensure data readiness ahead of hurricane seasons.

Read more about 6 Data-driven strategies emergency managers should use for hurricane preparedness →