Contact us

Get in touch with our experts to find out the possibilities daily truth data holds for your organization.

Persistent Monitoring

Natural catastrophe solutions

25 June 2021 | Solutions

5 min read

Head of Product Marketing, ICEYE

Responsive insurers who step up to support customers during flood events will find their level of emotional and financial care reciprocated by the holy grail of insurance relationships: customer loyalty. Claims management is an opportunity for insurers to shine — a strategic and financial imperative. ICEYE data can be integrated into your processes to help you shine when it matters most.

When catastrophic flooding in March 2021 severely impacted Australia’s east and southeast coastal regions, the rains lasted several days, extending inland over a vast stretch of the country. In Port Macquarie and Taree, ICEYE’s flood analysis2 revealed almost 4,000 flooded properties over a 600 km2 area to give a sense of scale. In Sydney, ICEYE’s flood analysis3 indicated over 1,800 flooded properties with a 2 meter average flood depth. Traditionally, it can take months before homeowners in affected regions get relief in these situations. Using current processes and technology, getting an accurate picture of flooding events takes precious time, which impacts how quickly insurers can respond to their customers. This is where ICEYE data can help.

Claims excellence comes down to exceeding policyholder expectations, measured by the claims excellence dimensions.

| Dimension | Description | Examples |

|

Contact Speed |

How quickly could I contact the insurance company? |

Did I have to spend a long time on the phone to the claims line? |

|

Contact Ease |

How easy was it to contact the insurance company? |

What were the contact options provided? How easy was it to find those details? Was customer service aware of my situation? |

|

Claim Execution |

How quickly was the claim resolved? |

How soon was the claims adjustment made? How long after did I receive the agreed financial support? How quickly are disputes resolved? |

|

Return to Normality |

How quickly was I able to get back to my pre-flood routine? |

How quickly was I able to get back into my house? |

When we look at our claims excellence dimensions, how an insurer performs can be summarized in a customer Claims Excellence Index (CEI): a higher overall CEI increases customer trust and, therefore, customer loyalty.

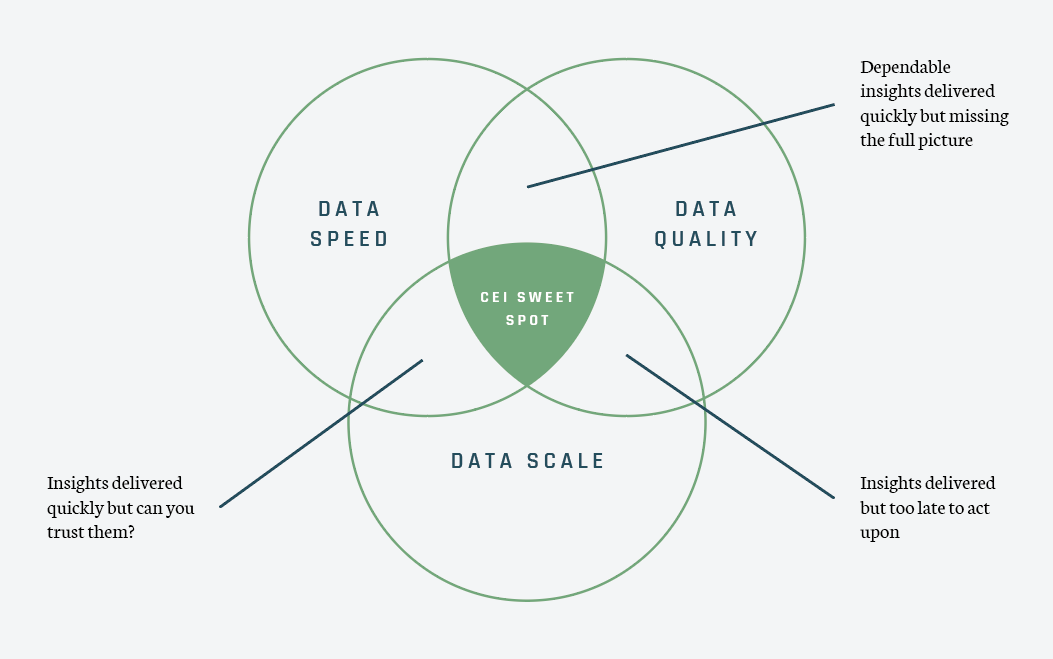

Achieving this requires the right data: a high-quality, fast delivery solution (with rapid refreshment) that scales geographically — as shown in Figure 1.

The mix of Data Speed, Data Quality, and Data Scale ensures you stay focused strategically on the "Claims Excellence Index sweet spot" and can strengthen your position in the market; it ensures you stay focused strategically on the CEI sweet spot and can strengthen your position in the market.

Figure 1: How to use data to drive higher CEI

Find an example of how we capture flooding here.

Discover how the insurance industry can save $1 billion a year and improve customer relationships with the right data.

Sources:28 October 2025

Flood Ready: How insurers can act faster with satellite insights

Discover how satellite flood monitoring helps insurers gain real-time situational awareness and...

Read more about Flood Ready: How insurers can act faster with satellite insights →15 October 2025

From forecast to fact: Multi-peril data for insurers

ICEYE's Monte Carlo workshop revealed how SAR satellite data transforms hurricane response and...

Read more about From forecast to fact: Multi-peril data for insurers →11 June 2025

6 Data-driven strategies emergency managers should use for hurricane preparedness

How Emergency Managers can ensure data readiness ahead of hurricane seasons.

Read more about 6 Data-driven strategies emergency managers should use for hurricane preparedness →